The University of Texas at Dallas offers a MasterCard One Card Program for procuring supplies, payment of business services and covering business related travel expenditures not found in eProcurement or the University travel agencies. This program simplifies the procure-to-pay (P2P) process and is an inherently fast, flexible method of processing low dollar, infrequent purchases that cannot be handled in any other way, from suppliers that accept the MasterCard credit card.

The One Card Program is authorized by a Texas Procurement and Support Services (TPASS) contract with Citibank. With the One Card you may purchase non-restricted goods and services directly from suppliers. The One Card also allows cardholders to cover authorized travel and related expenditures while in travel status. This program will reduce the time and effort required to make payments for university purchases. The use of the One Card to pay for a purchase does not exempt the university or its officers and employees from the purchasing/travel requirements of state law and the TPASS.

Additional information can be found in the One Card Process Manual , One Card Detail Guide

, or on our Training Materials page.

If you have any questions, please email onecard@utdallas.edu.

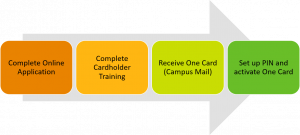

To apply for a University issued One Card, you need to complete the One Card Request Form. This form is accessed via the Galaxy portal, through Gemini > Gemini for Departments > Forms > One Card and Travel > One Card Request. Once the application is approved by your supervisor and fiscal officer, you will need to complete a pre-training questionnaire and then cardholder training. If approved by the One Card team, you will receive your One Card via campus mail, then you will need to set up a PIN and activate the card. Please see One Card Application Quick Guide for instructions.

Please see One Card Application Approver Quick Guide for instructions on the approval process.

The One Card works a lot like a credit card. A cardholder may make low dollar value purchases (up to the maximum single transaction limit on the individual card) from suppliers that accept MasterCard credit cards. The card may be used for purchases of goods and services specifically related to the cardholder’s area of expertise and/or their job-related duties at The University of Texas at Dallas.

Restricted Uses:

Caution!

Each One Card transaction should be reviewed by the cardholder and/or their designee (reconciler) in Gemini Financial > Financial Compliance > One Card Reconciliation > One Card Reconciliation. The cost center and account number should be reviewed for accuracy. The business justification should be filled out to provide a description of the good or service and its value to the UTD. Each transaction should have a receipt attached that is reviewed and compared to every transaction.

An approver must approve the period’s transactions electronically using the Approval tile in Gemini Financials.

Please see Updating a One Card Statement – Quick Guide for instructions on the reconciliation process.

Itemized receipts or invoices, showing a line item detail of what was purchased and for how much, are the only acceptable forms of documentation for One Card transactions. Receipts must also be fully readable, without faded ink or missing parts.

If an original itemized receipt is lost and the billing agency is unable to provide a duplicate copy, then the Missing Receipt Form must be completed for the missing itemized receipt. Note: The form cannot be used for Airfare, Hotels, Rental Cars, Uber or Lyft. These vendors are required to provide proper receipt documentation.

If the Missing Receipt Form is approved, attach the approved form to the appropriate transaction in the One Card reconciliation. If the form is denied you will need to make arrangement to reimburse the University.

General information and instructions can be found in the PeopleSoft Missing Receipt Form Quick Guide

For a more One Card resources, please refer to the list below:

The One Card program is serviced using a team approach with CITI Bank’s Customer Service Center. This center is available 24 hours a day, 7 days a week to assist the cardholder with general questions about the Purchasing Card account.

CITI Bank Customer Service can be reached at 1-800-248-4553.

The One Card team and Citibank can both help with specific types of problems:

| Common Issues | Recommended Action |

|---|---|

| If you lose your card | Call Citibank at 1-800-248-4553 |

| To dispute a transaction | Work with the supplier then call Citibank at 1-800-248-4553 if a resolution cannot be reached. |

| If you forget your PIN | Call Citibank to expedite the reset at 1-877-905-1855 |

| If you are traveling and your card is rejected | Call the number on the back of the card to find out why. If your card was not approved for travel, you may have to use a personal card. |

| If you change departments and the new department wants you to keep your One Card | Notify onecard@utdallas.edu and we will request that you submit an updated application with new information on it (Department, cost center information, approvers etc.). Normally we give you ten days to respond. |

| When you leave a position that no longer needs a One Card or leave the University | Notify onecard@utdallas.edu. Check GCMS and ensure that you have all your receipts. Provide your receipts for all transactions to your reconciler. Shred your One Card. |

| If you have a new supervisor | Submit an updated application. In the Special Request box include the following: “New Supervisor – effective XX/XX/XXXX” |

| If you have a Name Change | Submit an updated application. In the Special Request box include the following: “First or Last Name change from XXXX to XXXX” |

The One Card program is serviced using a team approach with CITI Bank’s Customer Service Center. This center is available 24 hours a day, 7 days a week to assist the cardholder with general questions about the Purchasing Card account.

CITI Bank Customer Service can be reached at 1-800-248-4553.